Rules of the Investment Game

Rule #1

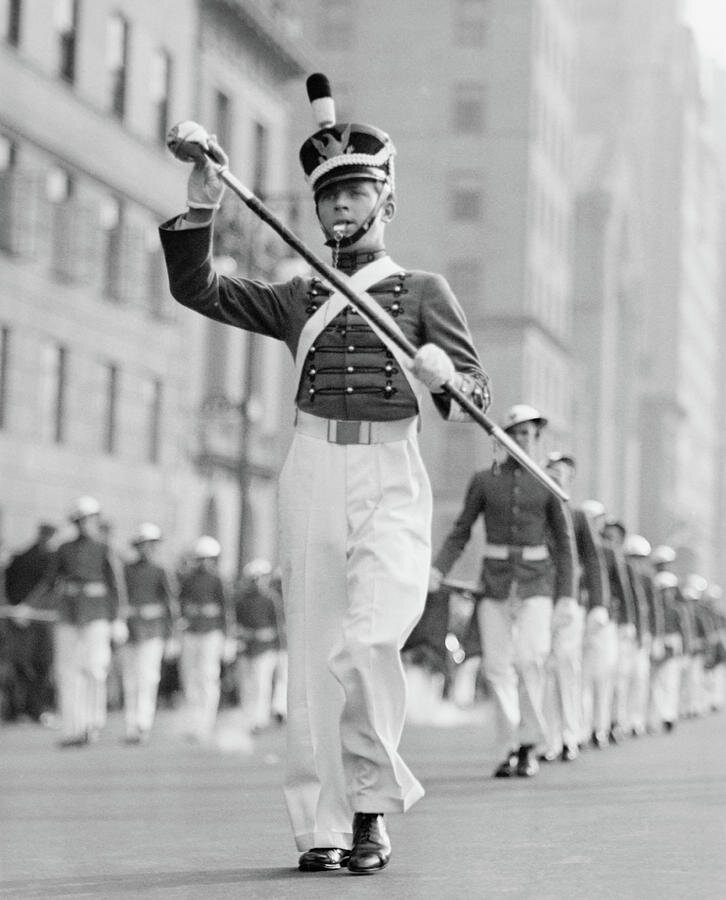

Find the parade and get out in front.

Rule #4

When analyzing growing companies, ignore earnings and focus on investment.

Rule #7

Avoid the crowd at all costs.

Rule #10

Adversity removes the fragile and spares the robust.

Rule #13

Bubbles are the most destructive force known to mankind.

Rule #16

Buy on the cannons, sell on the trumpets.

Rule #19

Water the flowers, pull the weeds.

Rule #22

Booms hide a multitude of sins.

Rule #25

Take ownership of the data. Don’t blindly trust statisticians.

Rule #2

Pay attention to addictive consumer brands.

Rule #5

Buy right and sit tight.

Rule #8

It’s a market of stocks, not a stock market.

Rule #11

Cui bono? In politics, consider who benefits.

Rule #14

Sell the shortage, buy the glut.

Rule #17

If government is leading the parade, quietly slip out the back.

Rule #20

An uptrend met with skepticism is still early.

Rule #23

View the world through a non-interventionist lens.

Rule #26

Check your ego at the door. The market doesn’t care what price you paid for a stock.

Rule #3

Growth can have a long runway when brands expand nationally and internationally.

Rule #6

Align yourself with people who have skin in the game.

Rule #9

In a panic all correlations go to 1. Panics always create buying opportunities.

Rule #12

The retail investor is always late to the party.

Rule #15

Beware simple narratives.

Rule #18

Due to high leverage, fickle capital and exposure to bubbles, most banks are uninvestable.

Rule #21

With technology, settlers get rich after pioneers take the arrows in the back.

Rule #24

Avoid binary thinking. Find similarities where others see only differences.