Transaction log

May 16, 2022 - Bought 25 @ $57.03 (0.91% wtg, opportunistic)

Aug 9, 2022 - Bought 20 @ $70.35 (45 shares, 2.24% wtg)

Oct 5, 2023 - Bought 10 @ 84.96 (55 shares, 3.14% wtg)

Crocs

Location: Broomfield, Colorado

Profile

Industry: Footwear & accessories

Sector: Consumer discretionary

Theme: Emerging markets consumer

5-Year shareholder growth: +30.9%/year

Fair value estimate: $186

Valuation assumption: 6.0% MFCF yield

Crocs was down 19% on disappointing Q3 results. Cause for concern or buying opportunity?

AEO and CROX up after reporting better Q4 sales and margins…

Introducing Coffee Can rule #19: Water the flowers, pull the weeds. [trades]

Crocs brand president Michelle Poole: “The key trends we see emerging in China and well-aligned to the Crocs brand are self-expression and personalization, clogs and travel.”

CROX Q2: wholesale snags at HEYDUDE have investors selling, stock down 14%. This feels like an overreaction as the rest of the business is humming, HEYDUDE problems likely short-term in nature. At 9 x earnings, CROX is too cheap.

Does Crocs have legs? A first look at the HEYDUDE acquisition.

While GAMCO underwhelms with its ESG bona fides, Crocs overwhelms with its HEYDUDE acquisition. R.I.P. Olivia Newton-John. [trades]

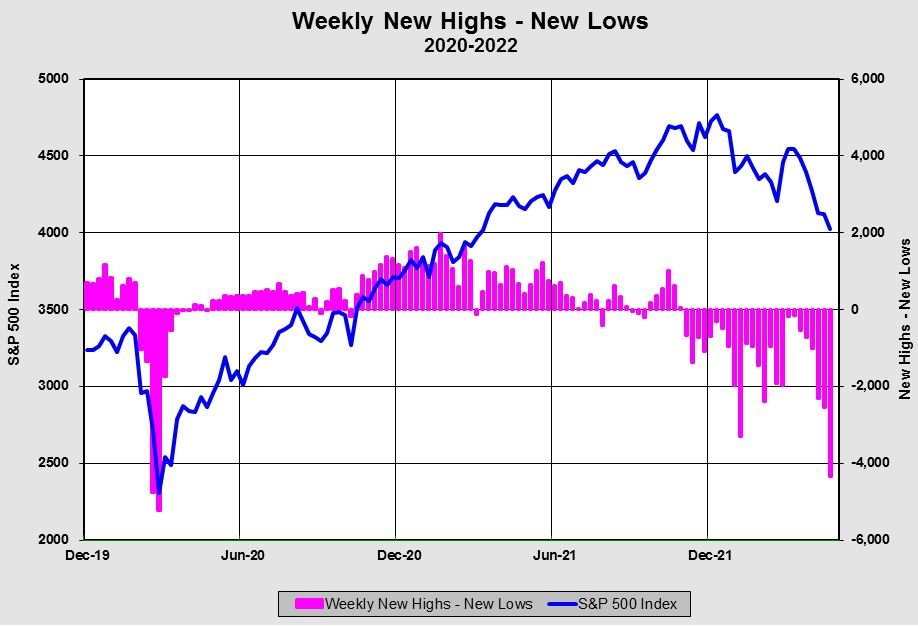

Negatives: recession on the way, big tech stocks still not cheap. Positives: bearish sentiment, lots of selling pressure below the surface. How these countervailing forces resolve themselves is an open question, but many high quality growth stocks are reasonably priced. [trades]